Re: Private Motor & Light Commercial Vehicle New Business Audits

Patrona Underwriting Limited is committed to ensuring best practice and quality of customer service provided to the consumer through our broker sales network in line with regulatory guidelines set out by the Central Bank of Ireland. Our belief is that by working together openly and honestly we will serve the best interests of Irish insurance consumers whilst complying with the regulatory obligations which guide our organisations allowing us to secure our mutual business success in a challenging market.

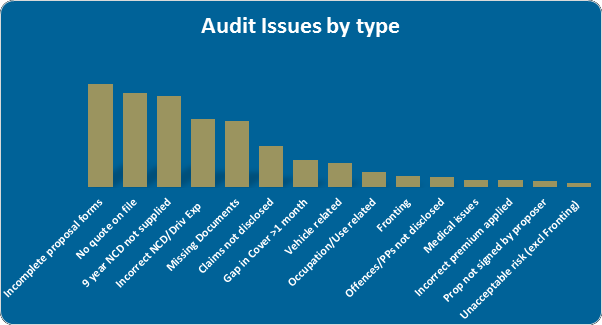

We have now completed our first round of Broker New Business Audits which represents over 50% of our Flexi-Car and Flexi-Van policies. We would like to share with you, our partners, the most common causes of issues discovered through the audit process to date.

The main issues identified were:

- Incomplete or unsigned proposal forms

- Missing quote documentation

- Misdeclared or unproven No Claims Discount

- Missing or incorrect verifying documentation such as Driving Licences

- Previous claims or driving offences (convictions, penalty points) not or incorrectly disclosed

The benefits of ongoing audits:

- Protects Consumers by avoiding the risk of non-disclosure, allowing valid claims to be paid on time and in full.

- Protects brokers, Patrona and our Capacity Providers by correctly underwriting and pricing new business.

- Identifies system, process & documentation issues

- Improves our underwriting and service as we apply our learnings into improving the risk appetite, business acceptance criteria and processes.

Patrona Underwriting will undertake further broker audits throughout 2016 and will continue to share the results with you.

Patrona Quality Assurance Team, March 2016